“Any difference you think you may have is not a shortcoming. It’s always your springboard,” says Valeria Vitola. “You have to embrace that diverse part of you, because it’s only through diversity that we thrive.”

“Any difference you think you may have is not a shortcoming. It’s always your springboard,” says Valeria Vitola. “You have to embrace that diverse part of you, because it’s only through diversity that we thrive.”

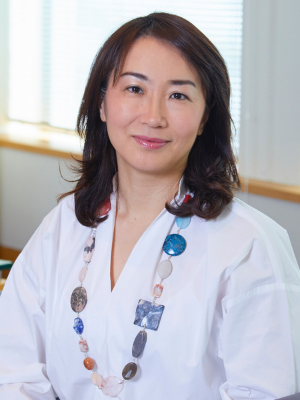

Born and based in Guatemala, Vitola speaks about why you have to dig even deeper to understand any problem, moving from shame to pride from the inside-out and the true value of bringing your difference to any situation.

Making a Societal Impact

Valeria comes from an Italian family who fell in love with the textiles of Guatemala and began a textile factory and textiles related industries in the country. Coming from a history of family-owned business, she never envisioned herself at a multinational company.

Now, twenty-two years have passed since accepting her initial offer and postponing her master’s degree indefinitely for the experiential MBA of Citi. Before working in anti-money laundering/financial crimes prevention, Valeria had witnessed the consequences of corruption in her country and found meaning in work that helps to narrow the inequalities that it helps to create.

“I am from a country where corruption impacts society – contributing to a gap between those who have lots and those who have not even a dollar a day to live, and denying access of vital services such as health, education and safety,” she says. “For me, to be in the frontline, making sure that the financial institution that I work for is not used by criminal organizations to launder money, or move proceeds, really feels like having an impact on society.”

Getting Way Underneath the Problem

Valeria brings unexpected diversity to the table – she’s a woman, she leads Latin America from Guatemala (even though Guatemala is not a major regional hub for Citibank), English is not her first language and she is part of the LGBTQ+ community.

“Being from a diverse environment allows me to see everybody’s perspective from a different angle, with empathy,” says Valeria. “I’m a good listener, so my leadership begins with listening. I’m really interested in understanding not only the job and the problem that people are bringing to the table, but also the whole situation they’re experiencing when they bring the problem.”

This proves especially valuable when conducting financial crimes risk assessment on client prospects and transactions. Her ability to get underneath a situation, and ask the critical questions, is one of the key skills that has supported both her career and her life.

“I like to take complex problems and divide them into simpler ones, and I like to do that very fast. Every single problem, no matter how big, can be dissected, once you understand the root cause,” Valeria says. “But when you think you know the cause, you have to dig deeper and deeper. Once you have the root cause, everything else gets easier. You can find the paths to resolve the problem.”

Speaking to a skill that applies in all areas of life, Valeria likens this analytical skill to what empathy asks of us – when it comes to understanding why a person is feeling or behaving a certain way, and not jumping to a conclusion.

“The brain works in a way that sometimes likes to trick you into into thinking that you already know what the problem is,” she says. “But once you go layer after layer after layer, you identify there’s always something deeper. You usually have to go at least three layers, to make sure you’re addressing the true causes of the problem.”

Valeria also possesses an instinct for accountability: “I’m that person that when I see the ball being thrown, will run, catch the ball and make sure that I don’t drop the ball until it gets delivered to where it needs to be.”

Being a Leader is For Others

Vitola confesses that as an economist, what drew her into her profession was the notion of working all by herself, at a desk, analyzing numbers, with nobody reporting to her.

She stared at Citi as a sole contributor and she says that during her tenure she sought positions where she did not have to manage others. Reluctant to be working with and be responsible for so many others, Vitola remembers what her female boss and mentor, told her: “You have to believe that you are enough and more, and that you need to inspire people – and not for your sake, but for the sake of the people that are below you.” And that is how Valeria now leads a group of around 400 financial crimes professionals in over 18 different countries.

Before she speaks in front of an audience or accepts a role with more exposure and responsibilities, Valeria remembers those words. While working with others can be energy-absorbing and disruptive to an introverted disposition, she has come to understand her mission is not about tasks, but inspiring people to achieve their own whole potential, which is part of why listening has become essential.

180 Degrees From Shame To Pride

Within her family and her work, Valeria never felt held back by being a woman. Being comfortable sharing about her family and personal life as a lesbian, however, has taken longer to relax into.

“Back in the 90’s, I don’t think I knew another lesbian, not only in the financial industry but the whole country, so I felt very insecure about letting people inside of my world,” she says. “Citi is an organization that really embraces and encourages diversity, and how diversity brings different views to the table, so it was never about Citi. It was complicated for me because of fears related to my traditional catholic upbringing, my family, my friends and society in Guatemala. Coming out of the closet has been the most terrifying decision I’ve taken in my career.”

Last year, a photo of her family, including her 17 year old daughter and her ex-wife, appeared on the cover of Citi’s annual diversity report. Vitola says that her daughter, Alessandra, has been her greatest teacher: “She’s shown me the path of openness. She’s never been ashamed of her diverse family and has always introduced me as her mother.”

Valeria now feels that pride is the opposite of shame, and the journey towards becoming who you are also includes leaving behind the isolation of shame, which she too long imposed on herself in the workplace. If she has one regret, it’s that she held back for so long, only to suffer stress and fears around her identity, when in the end, it didn’t matter to any of her colleagues, only to her. If she could go back, she’d bring her whole self from day one and hopes that being more visible now shines a light for others, especially those based in countries where it might be more difficult.

In all ways, she’s now come to see her differences as an asset, and encourages those she mentors to do so, too.

“If you have a room full of people thinking the same way, with the same upbringing and same everything, the solution that you’re going to attain is going to be very limited.” she says, “So, you have to embrace who you are. Bring your difference to the table because that is what really adds value to an organization, to a meeting, to a friendship, to anything. That diverse point of view is what makes everything grow.”

Leading and Doing with Heart

Valeria is inspired by how Jane Fraser, CEO of Citi, leads with empathy, giving everybody a seat on the table, and caring about all stakeholders.

“I love having a leader with heart, more than one that just executes,” says Vitola. “Instead of having a chain, like an army, it feels more like a room with friends and family, where everybody is heard and all opinions are taken into account. But someone is responsible, deciding when we’ve all been heard enough and saying let’s move together now, behind this higher vision.”

During the beginning of the 2020 lockdown, and grounded from the three weeks a month she used to spend traveling, Valeria initiated a spare time challenge with her 400 strong Citi team and family, inviting everyone to share their personal interests, as a way of staying connected. The effort was then replicated in other areas and regions of Citibank.

Akin to her fascination of going deep into the mechanics of a problem, one of her own passions is restoring old and defunct machines – from the original espresso machine to a 1960 Vespa (which she rides on the city streets of Antigua, Guatemala on her weekends) – including sourcing all the technical hard-to-find parts they need to work again. As a girl, she watched her father and grandfather repair machines for the textile factory, often with parts imported from Italy that took weeks just to arrive.

“I have a personal satisfaction in bringing something back to its old shine and glory – to see the inside of a machine and how it works, from the time before electronics,” she says. “It’s a tribute to the ingenuity of the people that designed the machine to bring it back to life.”

Valeria is a scuba divemaster and also loves gardening, because it offers many transferable lessons and helps her stay in the present moment, from planting a seed, to waiting for weeks (with trust) until it germinates, to giving it the space to grow, to cultivating the fruit and making marmalade to share with and gift to friends: “Going from the seed to the product, with love, is like sharing a part of me, of my time, of myself.”

By Aimee Hansen