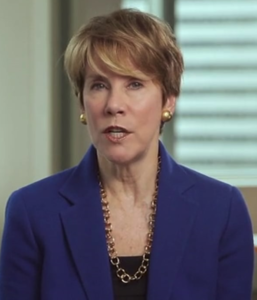

“For two years in my bathroom, there was a post-it on my mirror that said “Partner,” shared Nicole Pullen Ross, region head of the New York Private Wealth Management (PWM) business at Goldman Sachs. She also leads the PWM Sports and Entertainment Solutions (SES) offering.

“For two years in my bathroom, there was a post-it on my mirror that said “Partner,” shared Nicole Pullen Ross, region head of the New York Private Wealth Management (PWM) business at Goldman Sachs. She also leads the PWM Sports and Entertainment Solutions (SES) offering.

Ross, who was named partner in 2020, said of her experience being promoted: “My career has been focused on working hard for our clients and our business. To be named partner in 2020, and recognized and rewarded for my hard work and dedication to the firm, was an extraordinary accomplishment.”

Identifying a Need – and Founding a Specialty Offering

Ross, who joined Goldman Sachs in 1999 after a stint at JP Morgan and business school, was focused on advising individuals and families within PWM. Over the course of her career, she honed her skills as a Private Wealth Advisor (PWA). Ross now serves as region head of the New York PWM business, and in 2018, led the effort to found the PWM Sports and Entertainment Solutions offering.

“We founded the offering with the aim of supporting the complex financial needs of athletes, entertainers and those in the industry,” Ross said. “We were confident Goldman Sachs could provide differentiated services and advice to this unique client group.”

“I always remind myself what a privilege it is to be busy doing such extraordinary work with so many incredible clients,” Ross said.

The Importance of Being “Bold” and Investing in Women

As she gained seniority throughout her career, Ross became aware of what an important role being “bold and confident” has on an individual’s career. “When I began my career, like many women, my confidence was tied to how much I thought I knew about a topic,” she said. “Now, I appreciate that there is a combination of things that are important – you have to be excellent and be a content expert, but you also need confidence in your own voice, be present and be bold, in order to be seen as a leader.”

PWM’s launch of WRAP – or Women Reaching Accelerated Potential – was referenced by Ross as one way in which the business aims to support women’s career growth. “WRAP was founded by women within PWM, for women within PWM, with the goal of helping more women become successful PWAs,” Ross said. “By connecting participants with senior PWA mentors and other senior individuals across the firm, and equipping them with the skills to be successful, we’ve had great success.” She noted that “some of PWM’s most successful advisors” are WRAP alumnae.

Ross added that as a partner, she also serves as a mentor to a greater array of individuals across the firm. “The expectation from colleagues that they have access to leadership is one of the things that is special about Goldman Sachs,” Ross said. “The opportunity to engage with more junior members of the firm and provide advice and perspectives to more people is one of the most rewarding aspects of my transition to partner.”

Delivering One Goldman Sachs to Clients

Commenting on her team’s focus on delivering “One Goldman Sachs” to clients, Ross said: “I’m very excited about the work we’re doing across the firm tied to the One Goldman Sachs initiative. We aim to bring one firm to our clients, with a seamless approach in terms of how they receive advice and guidance.”

Within PWM, Ross also shared the business hopes to “extend a sense of familiarity and community among our clients” and cultivate “authentic, trusted relationships” in order to best serve them. She noted that PWM is doing this in several ways, including by developing tailored initiatives to target select client groups.

Ross referenced the recent launch of In the Lead, a platform providing insights, resources and advice to empower ultra-high net worth women to take the lead in their wealth, philanthropy and legacy as one such initiative. She also mentioned PWM’s focus on inclusive wealth, in which the firm aims to be the advisor of choice for diverse clients. “We want to ensure that our clients feel our platform and advice is aligned to and supports their diverse interests and needs,” Ross said.

Beyond the Day-to-Day

Ross also serves as the Americas head of the firm’s Black Network. She noted the network works alongside groups throughout the firm, including Human Capital Management. The Black Network “strives to accomplish important work related to the recruitment and retention of Black professionals at the firm,” Ross said. “I’m encouraged to continue this work, particularly as the firm just announced our most diverse managing director class ever – but there’s still more work to be done.”

Outside of the office, Ross prioritizes spending time with her family. “Our hobby is being together – my children are teenagers now, and I know they’ll be off to college in a few years,” she said. “Throughout the pandemic we were able to maximize our time together, which I really valued, and continue to do so even as things are opening back up again.”

In addition, Ross serves on the Board of Trustees of the Brookings Institute, Hampton University and the United Negro College Fund.