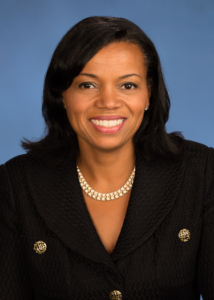

“Be passionate about your role and responsibilities – always apply yourself with energy, enthusiasm and commitment,” recommends Nell Hutton, a partner and head of the Securities Division franchise in Australia and New Zealand at Goldman Sachs.

“Be passionate about your role and responsibilities – always apply yourself with energy, enthusiasm and commitment,” recommends Nell Hutton, a partner and head of the Securities Division franchise in Australia and New Zealand at Goldman Sachs.

A native Australian, Nell Hutton traveled to the UK to pursue postgraduate studies at Cambridge University. From there, she joined Goldman Sachs’ debt capital markets (DCM) team in London, where she aimed to infuse those three core traits – energy, enthusiasm and commitment – to her projects.

“I worked extremely hard in DCM, and during that time period I learned an incredible amount and received a lot of great client exposure,” said Hutton of her time working in bank capital transactions.

After several years in DCM, Hutton was in search of a new challenge and joined the derivatives corporate team, where she covered corporate clients from a risk and liability management perspective. From there, she transitioned to the Financing Group, supporting Nordic and Dutch clients in the derivatives space. “I really enjoyed my time working with these clients because I built strong relationships with them, and we developed some innovative financing and hedging solutions which really differentiated Goldman Sachs at the time.”

Leveraging Mobility Across Regions

After nearly a decade at Goldman Sachs in the UK, Hutton explored moving back to Australia. “In 2006, I began to talk with my managers about potentially transferring to a role in Sydney, so I could be closer to my family.”

Although she was moving more than 10,000 miles, Hutton was able to take on a similar role in Sydney, covering corporates, financial institutions and pension funds within the derivatives space. However, Hutton soon recognized differences between the London and Sydney offices: “As a vice president, I realized I was one of the few senior women in Australia, and I had to figure out how to reinvent myself and build a business – but I surprised myself by how quickly I was able to build relationships in the local market and translate my experience from Europe to bring innovative financing and hedging solutions to Australian and New Zealand clients.”

Navigating Parental Leave

After having her first child and taking 12 months of parental leave, Hutton experienced trepidation about returning to the office. “In the moment, I thought taking off so much time was a career-ending decision, but I really enjoyed the months I was able to spend with my daughter at home. Ultimately, I came back to work part-time, which my bosses in Sydney were very supportive of and in the long run I think that had limited impact on my career at GS.”

In 2009, Hutton had her second child, and again her managers were supportive of her coming back to the office on an initial part-time basis, which later morphed back to full-time given the exciting opportunities Hutton was offered in her role leading the derivatives business within the financing group.

Looking back, and after having her third child, she says: “I wish I had been more open-minded and had trust that I would have the firm’s support navigating these inflection points in my life.”

In addition, Hutton recommends that individuals considering parenthood keep in mind the following Lean In adage: “Don’t leave before you leave.” She cautions, “If you’re planning around potentially needing to take time out of the workforce, then you’re already making decisions that are holding back your career. Don’t worry about how you might navigate things in the future – assume you will find whatever balance you seek and focus on the present.”

Pursuing Opportunities for Growth

In 2014, Hutton was named head of Fixed Income, Currency and Commodities Sales in Australia and New Zealand, overseeing more than 15 people. “We set about trying to grow our market share and find new business opportunities, and it was exciting to cover a broad client base.”

Today, Hutton is focused on growing the firm’s Securities Division in Australia and New Zealand and engaging more clients. “The firm has laid out a clear strategy, and in Australia we have the opportunity to grow wallet share in existing businesses, as well as new business lines.” Hutton cites the development of a corporate cash management business in-house, as well as opportunities to engage superannuation funds across the country, as clear areas of growth.

For young women focused on their own careers, Hutton stresses that when individuals are passionate about their role, “people notice and doors open.” She notes: “When those doors open, you have to overcome fears of failure, be agile and take risks to succeed. It’s not always easy, but if you can navigate the difficult times and learn from them, then you’ll come out with greater strength and resolve.”

A Full – and Joyful – Life Outside of the Office

“When you work at Goldman Sachs and have three young kids, life is full but it is also joyful,” says Hutton. She notes that “family time is incredibly special” to her, and she loves reading to her children each night. “I’ve had the chance to go back and read with my children all the books I loved growing up – those moments are precious.”

“Be Bold and Take Risks to Be an Agent of Change”

“Be Bold and Take Risks to Be an Agent of Change” To progress in your career, you have to get out of your comfort zone, says Goldman Sachs’ Miriam Wheeler, who was recently named a partner at the firm – a role that will come into effect in the New Year.

To progress in your career, you have to get out of your comfort zone, says Goldman Sachs’ Miriam Wheeler, who was recently named a partner at the firm – a role that will come into effect in the New Year. Given the sizable success that Goldman Sachs’

Given the sizable success that Goldman Sachs’